Content

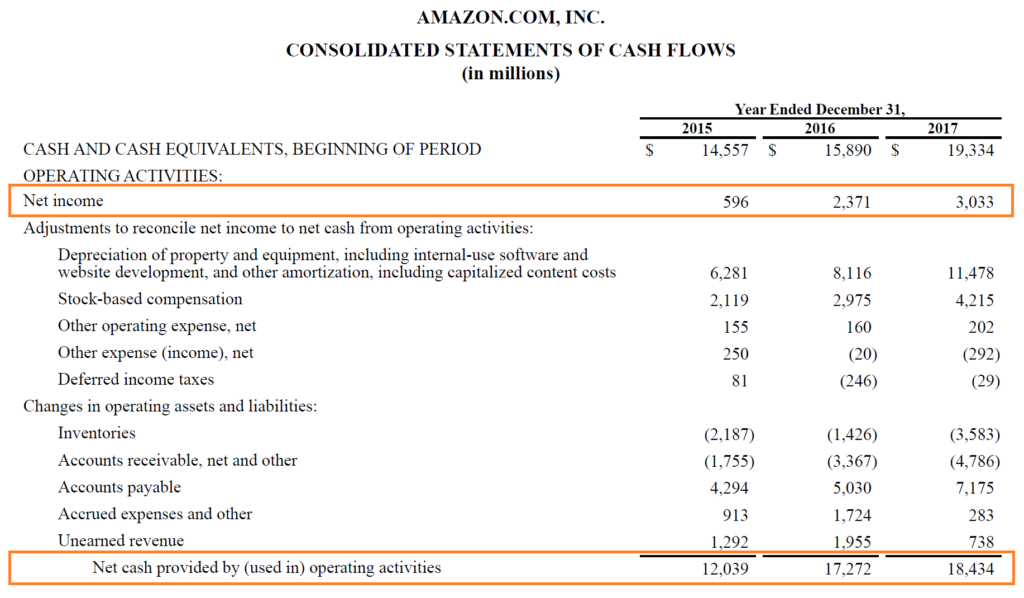

Using estimated rates of return, you can compare the value of the annuity payments to the lump sum. The present value interest factor may only be calculated if the annuity payments are for a predetermined amount spanning a predetermined range of time. The formula for the present value interest factor can be used to estimate the current worth of a sum of money. As we mentioned earlier, PVIFs are commonly presented in the form of a table. This is with values for different combinations for time periods and interest rates. Time value of money is the concept that a dollar received at a future date is worth less than if the same amount is received today.

PVIF Calculator is an online tool used to calculate PVIF or Present Value Interest Factor of a single dollar, rupee, etc. PVIF is used to determine the future discounted rate of a selected value as well as the current value of a particular series for a set number of periods. Checkout the PV Table below which shows PVIFs for rates from 0.25% to 20% and periods from 1 to 50. The present value of an annuity is the current value of future payments from that annuity, given a specified rate of return or discount rate.

Debt and Loans

The PVIFA Calculator is used to calculate the present value interest factor of annuity . PVIFA is a factor that can be used to calculate the present value of a series of annuities. Rule Of 69The Rule of 69 is a common rule for estimating the time it will take to double an investment with a continuous compounding interest rate. It does not provide an exact time, but it does provide a near approximation without relying on a mathematical formula. So let’s say you have the option to receive a payment of $10,000 today or in two years time. It’s the same amount of money whenever you receive it, but time is the important factor.

Natural leader who can motivate, encourage and advise people, she is an innovative and creative person. She generally adopts a creative approach to issue resolution and she continuously tries to accomplish things using her own thinking.

Recommended Finance Resources

This table is a particularly useful tool for comparing different scenarios with variable n and r values. The rate is displayed across the table’s top row, while the first column shows the number of periods. The interest rate per period is typically constant, but if it is not, use the average of all of the periods.

For easier reference, the PVIF is commonly shown in the form of a table. The table will usually provide the present value factors for a number of different combinations of time periods and discount rates. Because the PV of 1 table had the factors rounded to three decimal places, the pvifa table calculator answer ($85.70) differs slightly from the amount calculated using the PV formula ($85.73). Present Value Of An Annuity – Based on your inputs, this is the present value of the annuity you entered information for. The present value of any future value lump sum and future cash flows .